Inflation and the Erosion of Wealth

In this follow-up blog, to fiat money, I will do my best to tie that concept in with inflation to illustrate the detrimental effects of rising inflation on the average person’s wallet.

We can trace a lot of what we are currently experience to what occurred in 1971 and the removal from the Gold Standard but I won’t rehash it as that was covered here.

Fast forward to where we currently are today…

Fiat Money and Inflation: Unraveling the Impact on Your Wallet

Understanding inflation is crucial for making informed financial decisions and safeguarding the value of your hard-earned money. So, let's uncover the mysteries behind rising prices and the impact they have on your wallet.

Defining Inflation

Inflation refers to the general increase in prices of goods and services over time. It means that, on average, the purchasing power of a unit of currency decreases. These goods and services are very specific to the end consumer, meaning that inflation will affect individuals quite differently, therefore making it even trickier to quantify. As my consumption on a daily/weekly basis will differ from yours.

Economists commonly use various measures, such as the Consumer Price Index (CPI), to track inflation rates. The CPI tracks changes in the prices of a basket of representative goods and services to gauge the overall cost of living.

Causes of Inflation

Demand-Pull Inflation: When the demand for goods and services exceeds the available supply, it puts upward pressure on prices. Increased consumer spending, government policies, or changes in business investments can lead to demand-pull inflation. Our recent pandemic is a great example of demand-pull inflation.

Cost-Push Inflation: When the production costs for businesses rise, such as increased wages or higher raw material prices, it can lead to cost-push inflation. Businesses may pass on these higher costs to consumers through higher prices.

Monetary Inflation: This occurs when there is an increase in the money supply within an economy. If the money supply grows faster than the rate of economic growth, it can lead to too much money chasing too few goods, causing prices to rise. This is also something that occurred during the pandemic. I discussed the nature of the M2 Money Supply and its effect on asset price inflation here.

Inflation's Impact on Fiat Money

Purchasing Power Erosion: Inflation erodes the purchasing power of fiat money over time. As prices rise, the same amount of money buys fewer goods and services, reducing your standard of living if your income doesn't keep up with inflation. Your daily coffee from the local barista contains the same volume of coffee as last year, likely the same quality as well, however, it takes more money to purchase the same volume of coffee. Now span this cost increase across multiple goods and services you consume and you can get a sense of how your purchasing power has decreased.

Saving and Investing Considerations: Inflation affects the value of your savings and investments. If the rate of return on your investments doesn't outpace inflation, the real value of your money decreases over time. Meaning if you earn an interest rate of 3% (that’s quite generous) and inflation is at 5%, your real rate of return (savings rate-inflation rate) is at - 2% (you’re money is become worth less at a rate of 2% a year). Now if you’re wondering why it is common monetary and fiscal practice to aim for 2% inflation, that’s another story for a different day.

Planning for the Future: Inflation makes long-term financial planning essential. When estimating future expenses or setting retirement goals, it's crucial to consider the potential impact of inflation to ensure your financial security remains intact. This is where it gets tricky with those individuals who are solely relying on a pension for their retirement. Pension plans typically have a range of inflation that they base their investing models on. If inflation rates deviate from those models, then your pension is at risk of not being as valuable in the future as those same funds today.

How Inflation is Eroding Your Wealth

Inflation can be damaging to people's wealth for several reasons:

Erosion of Purchasing Power: It reduces the purchasing power of money over time. As prices rise, the same amount of money can buy fewer goods and services. This means that individuals need to spend more money to maintain their standard of living, leading to a decrease in their overall wealth.

Fixed Income and Savings: Inflation can be particularly detrimental to individuals on fixed incomes, such as retirees who rely on pension payments or interest from savings accounts. If the income or interest earned doesn't keep pace with inflation, their purchasing power declines, impacting their ability to meet expenses or maintain their desired lifestyle.

Impact on Savings and Investments: Inflation erodes the value of savings and investments that don't outpace inflation. For example, if the return on investments is lower than the inflation rate, the real value of the investments decreases over time. This can significantly affect long-term financial goals, such as retirement savings or education funds, and hinder wealth accumulation.

Uncertainty and Planning Challenges: Inflation introduces uncertainty into financial planning. It becomes challenging to predict future expenses, such as housing, education, or healthcare, which are typically affected by inflation. This uncertainty makes it difficult for individuals to accurately plan and save for future needs, potentially leaving them financially unprepared.

Unequal Impact: As stated earlier, Inflation can affect different individuals and socioeconomic groups differently. Those with lower incomes or fixed incomes may struggle more to cope with rising prices, as a larger portion of their income is allocated toward basic necessities. This can exacerbate income inequality and hinder upward mobility.

Psychological Impact: It can have a psychological impact on individuals, eroding confidence in the value of money and causing anxiety about future financial stability. This can lead to reduced consumer spending and economic slowdown as people become more cautious with their money.

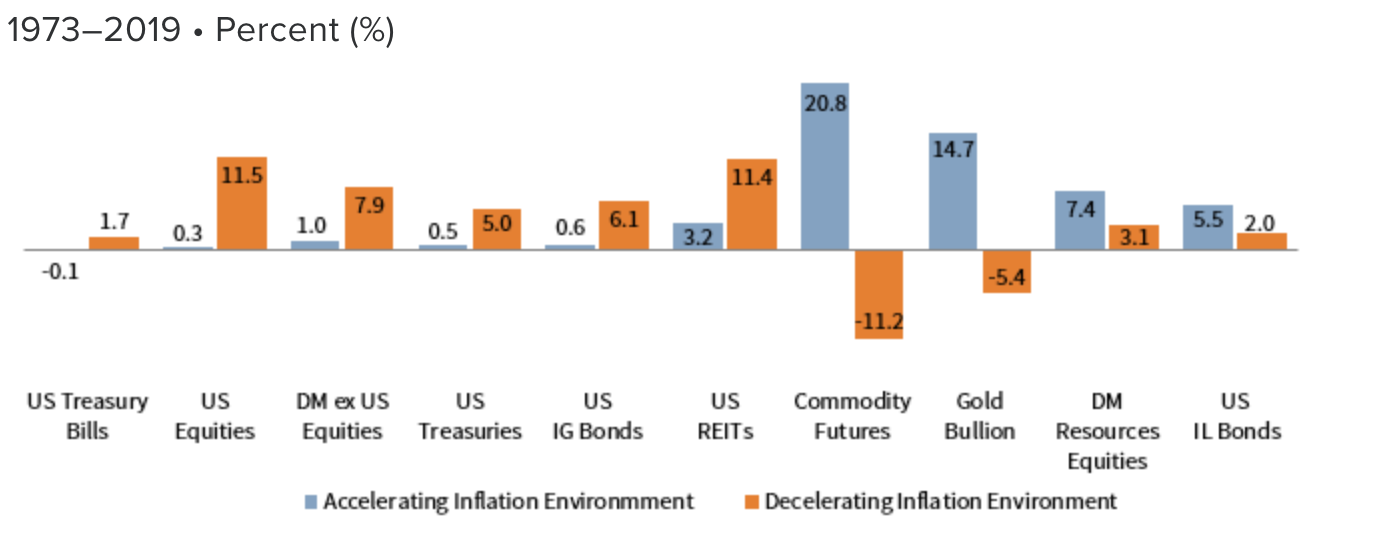

To mitigate the damaging effects of inflation, individuals can take proactive measures such as investing in assets that historically outperform inflation (e.g., stocks, real estate), diversifying their investments, negotiating for wage increases, and staying informed about personal finance strategies. By being proactive and adaptive, individuals can better protect their wealth and financial well-being in an inflationary environment.

Mitigating the Impact of Inflation

Diversification and Investment: Investing in assets that tend to outpace inflation, such as stocks, real estate, or inflation-protected securities, can help preserve and grow your wealth.

Wage Negotiations: Negotiating wage increases that keep up with or surpass inflation rates can help maintain your purchasing power and financial stability. Remember, if you are going to approach your employer to ask for a wage increase, present them with a case of how you have provided value and merit to the organization. In my opinion, your tenure isn’t sufficient to warrant a raise.

Financial Literacy and Planning: Being knowledgeable about personal finance, budgeting, and investment strategies empowers you to make informed decisions that protect your finances from the eroding effects of inflation. Personally and even though I am biased, I believe this is the single biggest factor that people can utilize to help combat the effects of inflation.

I believe understanding inflation is crucial for navigating the economic landscape, preserving your purchasing power, and securing your financial future. By staying informed, diversifying your investments, and planning strategically, you can mitigate the effects of inflation and ensure your hard-earned money retains its value over time.

I discuss in depth the effects of inflation on your wealth in my beginner course. For those who have an uneasy feeling about fiat money (don’t worry I have the same feeling) and want to expand their knowledge base and likely their portfolio allocation to more sound money, consider taking the intermediate course.

There are always those people who profess that they can time the market. I’m definitely not one of those people. Instead I use a tried and true approach backed with evidence to shape my investing decisions.