The Difference Between the Stock and Bond Market, Mutual Funds and ETFs

When I was first formulating the idea of launching a personal finance education business in 2021 I really had no clue a) whether it will succeed b) whether there is an appetite for this subject matter and c) what format would engage the audience and community the most effectively. The verdict is still out on the first point, but it has become clear to me that there is an appetite for this information, and that there is not just one format but many (asynchronous, synchronous, private, group setting, or written content) that allows the community to engage, learn from and apply this information.

What I also learned was that one of the best ways to gauge interest in a nascent idea is to beta-test it. In other ones, get feedback from the people you are looking to engage with!

Some of you may not know that I originally had one massive course (now it has been split up into the Beginner and Intermediate Course). The valuable feedback I received was that the course was too long (who wanted to sit through 5 hours of mainly didactic learning) and that some of the information was too complex and overwhelming. This insight was extremely valuable to me. I then created separate courses and started to teach them in a variety of settings. Starting with the beginner course (basically Adulting 101) and progressing to more complex concepts in the intermediate course.

I realized that over the last two years (despite having the material laid out in the beginner course) I hadn't written a blog about a concept that is littered across business radio, news, tabloids, podcasts, and even on your home personal assistant device; the stock and bond market and what the heck the difference is between a stock, bond, mutual fund, and exchange-traded fund.

So without further delay let’s dive into it.

Stock Market

The stock market refers to the collection of exchanges and platforms where buyers and sellers trade shares of ownership in publicly listed companies. It's a marketplace where individuals and institutional investors can buy and sell stocks, which represent ownership interests in businesses.

Key features of the stock market include:

Listed Companies: Publicly listed companies offer shares of their ownership to the public through initial public offerings (IPOs). Once listed, these companies' shares can be bought and sold on the stock market.

Stock Exchanges: Stock exchanges are organized marketplaces where stocks are traded. Examples include the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange (LSE), and Tokyo Stock Exchange (TSE).

Stock Symbols: Each company listed on an exchange has a unique stock symbol or ticker symbol, which is a short code used to identify and trade its shares. For example, Apple Inc. has the ticker symbol AAPL.

Buyers and Sellers: Investors who believe a company's stock will appreciate in value are buyers, while those who think the price will decline may be sellers. The interaction between buyers and sellers determines the stock's price.

Market Indices: Market indices, such as the S&P 500 or Dow Jones Industrial Average, track the performance of a selection of stocks, providing a snapshot of the overall market's health.

Volatility: Stock prices can be volatile, influenced by various factors including company performance, economic data, geopolitical events, and investor sentiment.

Investment Opportunities: The stock market offers individuals the opportunity to invest in a wide range of companies, sectors, and industries, potentially generating capital gains and dividends.

Investor Types: Different types of investors participate in the stock market, including retail investors (individuals), institutional investors (mutual funds, pension funds, etc.), and traders (short-term buyers and sellers).

Market Regulation: Regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC), oversee the stock market to ensure fair practices, prevent fraud, and protect investors' interests.

Investing in the stock market carries both potential rewards and risks. While stocks offer the potential for capital appreciation and dividends, their value can also decline, leading to potential losses. It's important for individuals to conduct thorough research, understand their risk tolerance, and consider their investment goals before participating in the stock market. Many investors also seek advice from financial professionals to make informed decisions.

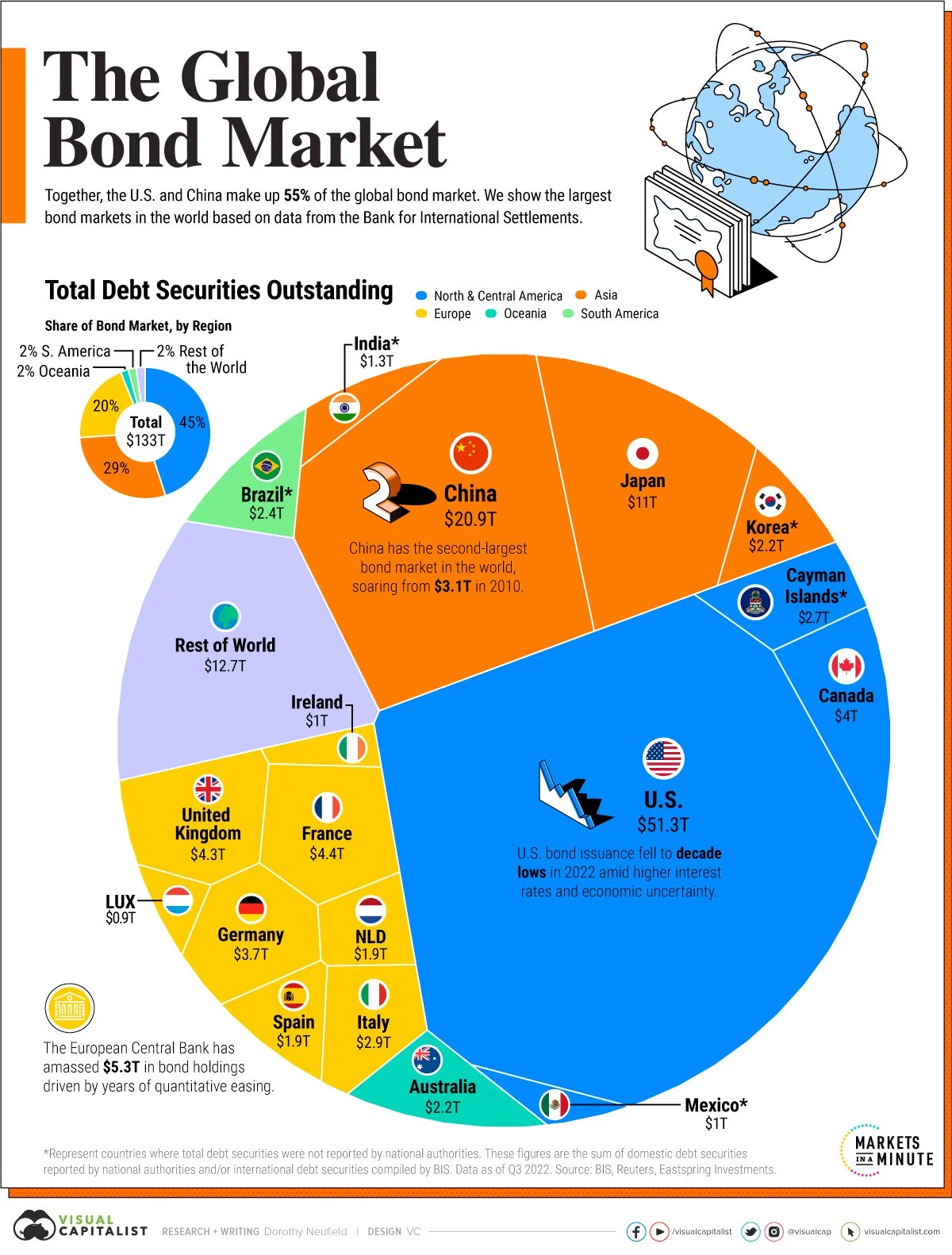

The brother to the stock market, despite being much larger in size but often overlooked and under mentioned is the

The Bond Market

The bond market, also known as the fixed-income market, is a financial marketplace where various entities issue and trade bonds. Bonds are debt securities that represent loans made by investors to governments, municipalities, corporations, or other entities. In essence, when you buy a bond, you are lending money to the issuer in exchange for regular interest payments and the return of the principal amount at a specified future date, known as the bond's maturity date.

Key features of the bond market include:

Bond Issuers: Entities that issue bonds include governments (federal, state, local), municipalities, corporations, and international organizations. These entities borrow money from bond investors to fund various projects, operations, or initiatives.

Bond Types: Bonds come in various types, such as government bonds, corporate bonds, municipal bonds, and international bonds. Each type has its own characteristics, risk profile, and potential returns.

Interest Payments: Bonds pay periodic interest payments, known as coupons, to bondholders. The coupon rate is predetermined when the bond is issued and represents the annual interest rate as a percentage of the bond's face value.

Maturity Date: Bonds have a fixed maturity date, which is when the issuer is obligated to repay the principal amount to bondholders. Upon maturity, bondholders receive the face value of the bond.

Secondary Market: After being issued, bonds can be traded on the secondary market, allowing investors to buy and sell bonds before they mature. The secondary market provides liquidity and allows investors to adjust their portfolios.

Yield: The yield of a bond is the annualized rate of return an investor can expect to receive if the bond is held until maturity. Yield takes into account the bond's current price, coupon rate, and time to maturity.

Credit Ratings: Credit rating agencies assess the creditworthiness of bond issuers and assign ratings that indicate the level of risk associated with the bonds. Higher-rated bonds generally have lower default risk but may offer lower yields.

Diversification: Bonds can provide diversification benefits to a portfolio, as their performance is often less correlated with that of stocks. This can help manage overall portfolio risk.

Risk and Return: Bonds are generally considered lower-risk investments compared to stocks, but they may offer lower potential returns. The risk and return characteristics of bonds vary based on factors like the issuer's credit quality and prevailing interest rates.

Investors choose to participate in the bond market for various reasons, such as seeking stable income, preserving capital, diversifying their portfolios, or managing risk. Like any investment, bonds carry their own set of risks, including interest rate risk, credit risk, and inflation risk. It's important for investors to carefully evaluate their investment goals, risk tolerance, and time horizon before investing in the bond market.

Now that you have a better understanding of each market, let’s talk about some of the ways you can gain exposure to those markets, by means of investment categories and vehicles.

What is a Stock, Bond, Mutual Fund and Exchange Traded Fund (ETF)

Stocks: A stock represents ownership in a company. When you buy a stock, you become a shareholder and own a portion of that company. As a shareholder, you may receive dividends (a portion of the company's profits) and have the potential to benefit from the company's growth in value. However, stock prices can be volatile and may go up or down based on various factors.

Example: If you buy shares of Apple Inc. (AAPL), you become a partial owner of Apple and can potentially benefit from its profits and growth.

Bonds: A bond is a debt instrument issued by a government or a corporation. When you buy a bond, you are essentially lending money to the issuer in exchange for periodic interest payments (coupons) and the return of the principal amount at maturity. Bonds are generally considered lower risk than stocks, but they also typically offer lower potential returns.

Example: If you buy a U.S. Treasury Bond with a face value of $1,000 and a 5% coupon rate, you will receive $50 in interest payments annually until maturity, at which point you'll receive the $1,000 principal back.

Mutual Funds: A mutual fund pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Professional fund managers manage the investments and make decisions about which assets to buy and sell. Investors in a mutual fund own shares of the fund itself, not the individual securities within it.

Example: If you invest in the Vanguard 500 Index Fund, you are buying a piece of a fund that tracks the performance of the S&P 500 Index, which represents the 500 largest publicly traded companies in the U.S.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds in that they pool money from investors to invest in a diversified portfolio of assets. However, ETFs are traded on stock exchanges like individual stocks. They can be bought and sold throughout the trading day at market prices. ETFs often aim to track a specific index or sector performance.

Example: The SPDR S&P 500 ETF (SPY) is an ETF that aims to replicate the performance of the S&P 500 Index. Investors can buy and sell shares of SPY on stock exchanges just like they would with a stock.

In summary, stocks represent ownership in a company, bonds are debt instruments, mutual funds pool money to invest in diversified portfolios managed by professionals, and ETFs are similar to mutual funds but trade on stock exchanges. Each investment vehicle has its own risk and return characteristics, and the choice between them depends on an individual's financial goals, risk tolerance, and investment strategy.

Why would someone choose to invest in a stock, bond, mutual fund or ETF?

People choose to invest in stocks, bonds, mutual funds, and ETFs for various reasons, depending on their financial goals, risk tolerance, and investment preferences. Here's why someone might choose each type of investment:

Stocks:

Capital Appreciation: Stocks offer the potential for significant capital appreciation over time. If the company performs well, the value of the stock can increase, leading to profits for the investor.

Ownership: Investing in stocks allows individuals to become partial owners of companies and potentially benefit from their success and growth.

Diversification: Stocks can provide diversification in a portfolio, spreading risk across different industries and companies.

Bonds:

Income Generation: Bonds provide regular interest payments (coupons), making them attractive for income generation, especially for retirees or those seeking steady cash flow.

Capital Preservation: Bonds are generally considered less volatile than stocks, making them a suitable option for investors who prioritize capital preservation and lower risk.

Portfolio Diversification: Including bonds in a portfolio can help balance the risk of stocks and provide diversification.

Mutual Funds:

Diversification: Mutual funds offer instant diversification by investing in a variety of securities, which can help reduce the risk associated with investing in individual stocks or bonds.

Professional Management: Mutual funds are managed by professionals who make investment decisions on behalf of investors, saving them the time and effort of managing their own portfolios.

Accessibility: Mutual funds allow individuals to invest in a diversified portfolio with a relatively small amount of money.

ETFs:

Diversification: Like mutual funds, ETFs provide diversification, but they can be traded throughout the day on stock exchanges, offering flexibility to enter and exit positions.

Lower Costs: ETFs often have lower expense ratios compared to some mutual funds, which can lead to lower overall costs for investors.

Trading Flexibility: ETFs can be bought and sold in real-time at market prices, providing more control over the timing of trades.

Ultimately, the choice between stocks, bonds, mutual funds, and ETFs depends on individual financial goals and preferences. Some investors might opt for a mix of these investment types to create a balanced and diversified portfolio that aligns with their risk tolerance and objectives.

It's important for investors to carefully consider their investment strategy, conduct research, and, if needed, seek advice from financial professionals before making investment decisions.

I am a client of Wealthsimple and have thoroughly enjoyed what they have done to democratize access to investing to the everyday person. I do not hold any ETFs or use their robo-advisor services but did come across a few interesting charts that illustrate the importance of fees in a portfolio’s long term performance.

There are always those people who profess that they can time the market. I’m definitely not one of those people. Instead I use a tried and true approach backed with evidence to shape my investing decisions.