What’s in your Portfolio?

You can think about a portfolio as a basket of assets. In this basket, you can place all sorts of investments. Bonds, ETFs, Stocks, Mutual Funds, Real Estate etc can all be thrown in. Traditionally many people either through personal investment or through their financial professional, have had a combination of stocks and bonds. The weighting can vary from 90% stocks and 10% bonds to the inverse, 10% stocks, 90% bonds. Typically the scale is tipped towards 60% stocks and 40% bonds, dubbed the 60/40 (more financial jargon).

This is an excerpt from a recent article on CNBC discussing the possibility of the 60/40 portfolio being dead. I bring this concept up because I believe it would benefit the masses to make a switch to a more modern form of investing, based on current financial principles and not because it’s “what we always do” or any similar outdated dogma peddled by perverse incentives and malaligned professionals.

“The 60/40 portfolio — a cornerstone strategy for the average investor — has been stressed by the pandemic-era economy and market dynamics. However, “the 60/40 portfolio certainly isn’t dead,” Holly Newman Kroft, managing director and senior wealth advisor at asset manager Neuberger Berman, said Thursday at the semiannual CNBC Financial Advisor Summit.

While not dead, “it needs to be modernized,” she added.

What is a 60/40 portfolio?

The strategy allocates 60% to stocks and 40% to bonds — a traditional portfolio that carries a moderate level of risk. More generally, “60/40” is a sort of shorthand for the broader theme of investment diversification. The thinking is that when stocks — the growth engine of a portfolio — do poorly, bonds serve as a ballast since they often don’t move in tandem. The classic 60/40 mix is generally thought to include U.S. stocks and investment-grade bonds, like U.S. Treasury bonds and high-quality corporate debt.

Why the 60/40 portfolio is stressed

Through 2021, the 60/40 portfolio had performed well for investors. Investors got higher returns than those with more complex strategies during every trailing three-year period from mid-2009 to December 2021, according to an analysis authored last year by Amy Arnott, portfolio strategist for Morningstar.

However, things have changed.

Inflation spiked in 2022, peaking at a rate unseen in four decades. The U.S. Federal Reserve raised interest rates aggressively in response, which clobbered stocks and bonds. Bonds have historically served as a shock absorber in a 60/40 portfolio when stocks tank. But that defense mechanism broke down”

Don’t take it from me, but from the world’s largest asset manager, BlackRock.

“This portfolio challenge was on full display in 2022 as stock and bond returns were both meaningfully negative for the calendar year. In 2023, returns have been positive for both stocks and bonds, but the correlation has remained positive. This raises the question: is the “diversified” 60/40 portfolio back?

Our answer is that this largely depends on the future path of inflation. That is because persistent inflation would likely alter the monetary policy dynamics of the previous two decades. With inflation still well above the Fed’s 2% target, the Fed is less likely to materially cut interest rates in the face of a growth slowdown. That is because they would likely prioritize achieving their inflation target over cushioning a short-term downturn in economic growth. As a result, bonds may not offer the same degree of ballast in a 60/40 portfolio.”

Are bonds actual Risk-Free/ Risk-Off?

The traditional financial portfolio (at least for the last several decades) has been dubbed the 60/40 portfolio.

60% in stocks/equities . 40% in bonds (mixed duration)

The thought process is that they have an inverse relationship, when stocks sell off, bonds tend to rally, and vice versa.

In 2022, when stocks sold off, so did bonds, that trend has continued this year.

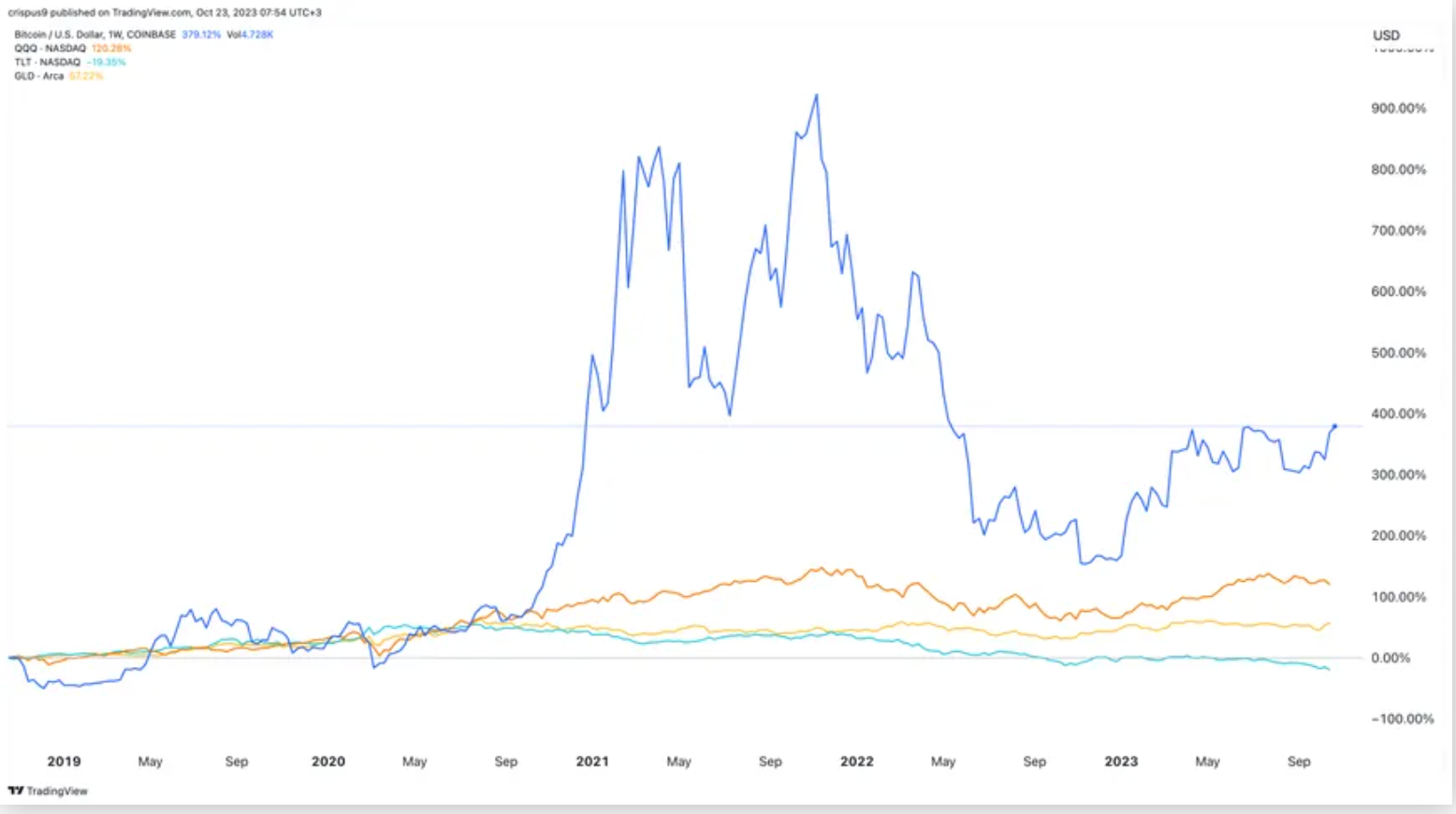

This chart elucidates that bonds have sold off (remember they are considered risk free) more than Bitcoin has in the last year (despite Bitcoin losing 70% value from it’s all time high in 2021)

Charts speak louder than words

Sorry for the poor quality chart. I do not possess a Bloomberg terminal so this was the best I could find that illustrates the last 4 years. The vertical axis is the % change.

Bitcoin is depicted in Blue

The Nasdaq (through QQQ) is in Orange

Bonds (through TLT) is in Green

Gold (through GLD) in, go figure, Gold.

Over the last 4 years, Bitcoin has not only outproduced all of these assets, but it has done so by a tremendous margin. Bitcoin has been touted as too risky and volatile. On the contrary, at least in the last 4 years, it is less risky than holding bonds. Holding bonds has actually lost you money.

Ask your financial advisor to explain this one

I love this visual, not only because it elucidates that bitcoin has been utterly dominant in achieving exceptional returns over the last 12 years but it does so by comparing it to a wide array of assets over the same time frame.

Do not hear what I am not saying.

I am not saying that you should invest your entire net worth in Bitcoin! That would be foolish to put all your eggs in one basket, regardless of the asset. What I am proposing, is that it would be worth a discussion and consideration to evaluate the utility of an alternative asset in the traditional financial portfolio.

Your advisor will likely tell you that bitcoin is toooooooo risky and volatile to be considered a component of a portfolio. That’s the industry’s refrain. Scroll down and show them the next graphic.

Charlie Bilello nails it again.

This tweet is from earlier this year but I believe the trend still persists.

Bitcoin has remained the best-performing asset in the last decade. For most of my clients, the last 10 years is all that matters as they are new to practice or have less than 10 years of working experience.

Of course, history is not indicative of future performance and this trend can change at a moment’s notice.

Nevertheless, it’s interesting to note, that an asset that was once called “rat poison squared”, “uninvestable” or too volatile can perform better than what is typically touted as safe and secure with solid returns. #gold #s&P.

To cite the opening article on ‘How to Rethink the 60/40 portfolio’ please read below

“That dynamic — stocks and bonds moving more in tandem — is likely to persist for a while, Paula Campbell Roberts, chief investment strategist for global wealth solutions at KKR, said at the summit. Indeed, while the Fed is unlikely to raise interest rates much higher (if at all), officials have also signaled they’re unlikely to cut rates anytime soon.

And there are some risks for U.S. stocks going forward, experts said. For one, while the S&P 500 is up 14% this year, those earnings are concentrated in just 10 of the biggest stocks, Roberts said.

That said, investors also benefit from higher interest rates since they can “access safer asset classes at a higher yield,” Kroft said. For example, banks are paying 5% to 5.5% on high yield cash accounts, and municipal bonds pay a tax-equivalent yield of about 7%, she said. Fed will start to pivot on rates in the second or third quarter of ’24, says Charles Schwab’s Jones. The Fed’s “higher for longer” mentality means bonds should have these equity-like returns for a longer period, Kroft said.

So, what does this mean for the 60/40 portfolio? For one, it doesn’t mean investors should dump their stocks, Kroft said. You never want to exit the asset class,” she said.

However, investors may consider substituting part — perhaps 10 percentage points — of their 60% stock allocation for so-called alternative investments, Kroft said.”

For me, someone who has been following traditional financial markets for quite some time, it’s comforting to hear traditional media referring to alternative investments as an investable product. Albeit quite broad, alternative assets are typically considered anything outside of stocks, bonds and traditional mutual funds. It is the domain in which cryptocurrency resides, more specifically, Bitcoin.

Disclosure: I am a Bitcoiner, it is the only cryptocurrency I hold and truly believe in. As with any investment, there is a risk of absolute loss of capital. Please do your own research and speak to a professional before making investment decisions.

There are always those people who profess that they can time the market. I’m definitely not one of those people. Instead I use a tried and true approach backed with evidence to shape my investing decisions.